The legacy of purely digitally available goods is playing an increasingly important role in our civil society. The assets of an estate or a person increasingly consist not only of cash or bank assets, shares, shares in companies or real estate, but also of intangible assets such as e-mail accounts, profiles in social media or access data to certain services or data.

The first question is whether data or access data or accounts can be inherited at all or whether they may be passed on to third parties in the event of a precaution. For example, many general terms and conditions expressly stipulate that access data may not be made accessible to a third party or that a service and the associated online profile are terminated upon the death of a contractual partner. A case in Berlin in 2012 caused a fuss: a girl was caught by a subway under unexplained circumstances and succumbed to her injuries. As a result, the girl's Facebook profile was placed in the so-called state of remembrance by Facebook, so that the parents could no longer fully access their profile even though they possessed the password for it. In the subsequent legal dispute against Facebook, which was based on the parents' access to their daughter's profile, the Bundesgerichtshof ruled in favor of the parents - unlike the previous instance. Beyond the concrete case, great importance is attributed to the judgement: It advocates the general heritability of the digital estate.

In addition, the technical feasibility of a solution is also in the foreground. In the case of a large company, the issue of access data may present a smaller problem than with other services, which may not be able to provide access to managed content to third parties or themselves, e.g. encrypted mailboxes. On the one hand, heirs or entitled persons want secure access to any digitally existing parts of the assets; on the other hand, the testator or grantor of power of attorney wants to prevent access to sensitive or valuable content before their own death. At the same time, a permanent and secure custody of the corresponding data and objects should be ensured so that information can neither be lost nor stolen. In this respect, the case of illness is comparable to the case of inheritance: Preventive proxies want quick and secure access to the digital assets or life of the principal, while the principal has an interest in ensuring that this only happens in the case of a precaution.

A solution to this problem is not obvious at first glance: Many of the proposals by startups or established companies fail because of a missing satisfactory combination of security, sustainable storage and user-friendliness: a solution that is secure but not user-friendly is much less likely to be used and thus increases the risk of being completely useless for the heirs in the event of death because nothing has been deposited. A central instance, which manages data for its customers, makes itself the target of hacker attacks, as the potential loot is much greater than if single users are attacked individually. Purely decentralized available approaches, which partly want to solve this problem by means of innovative technologies such as blockchain technology, lack capabilities which can only be carried out by central instances, e.g. checking the occurrence of death. Thus, solutions are offered on the market which require the naming of "trusted persons". By measuring the activity of the testator (e.g. the regular confirmation of e-mails) or by reporting the death of these "trusted third parties", the provider establishes that he is allowed to pass on the data, which entails great legal and technical difficulties.

A special case with digital assets is when the testator does not die but becomes legally incompetent. Here, too, there is a need for secure and reliable access to digital assets. No provider available on the market has yet taken this case into account, which is why the market analysis is limited to providers for the digital estate.

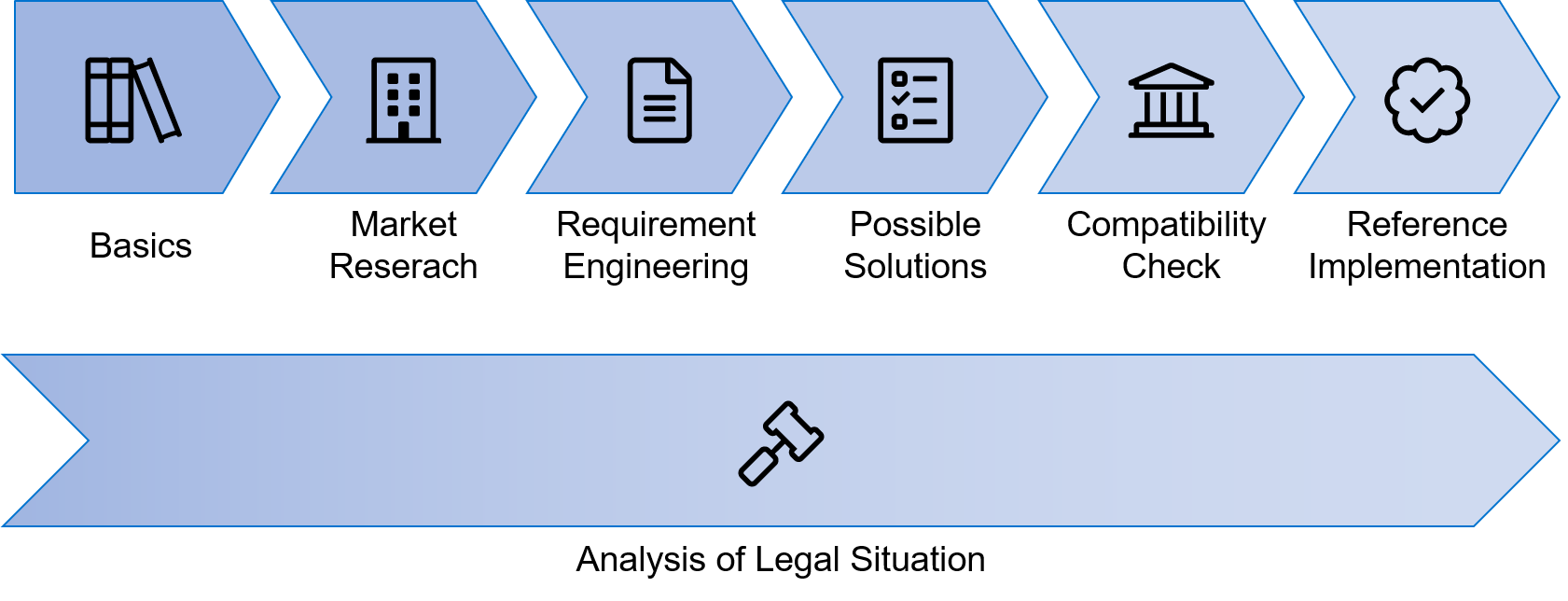

At the end of the study, a prototype of an estate and provision register is to be implemented.